Bitcoin Reserve: Crypto White House Summit

Crypto Market Reacts to U.S. Bitcoin Reserve Strategy, Saylor’s Bold Proposal, and White House Summit

Investor Disappointment Over U.S. Bitcoin Reserve Highlights Unrealistic Expectations

The recent unveiling of the U.S. Strategic Bitcoin Reserve has sparked a wave of disappointment across the crypto industry, exposing what regulatory experts see as unrealistic investor expectations.

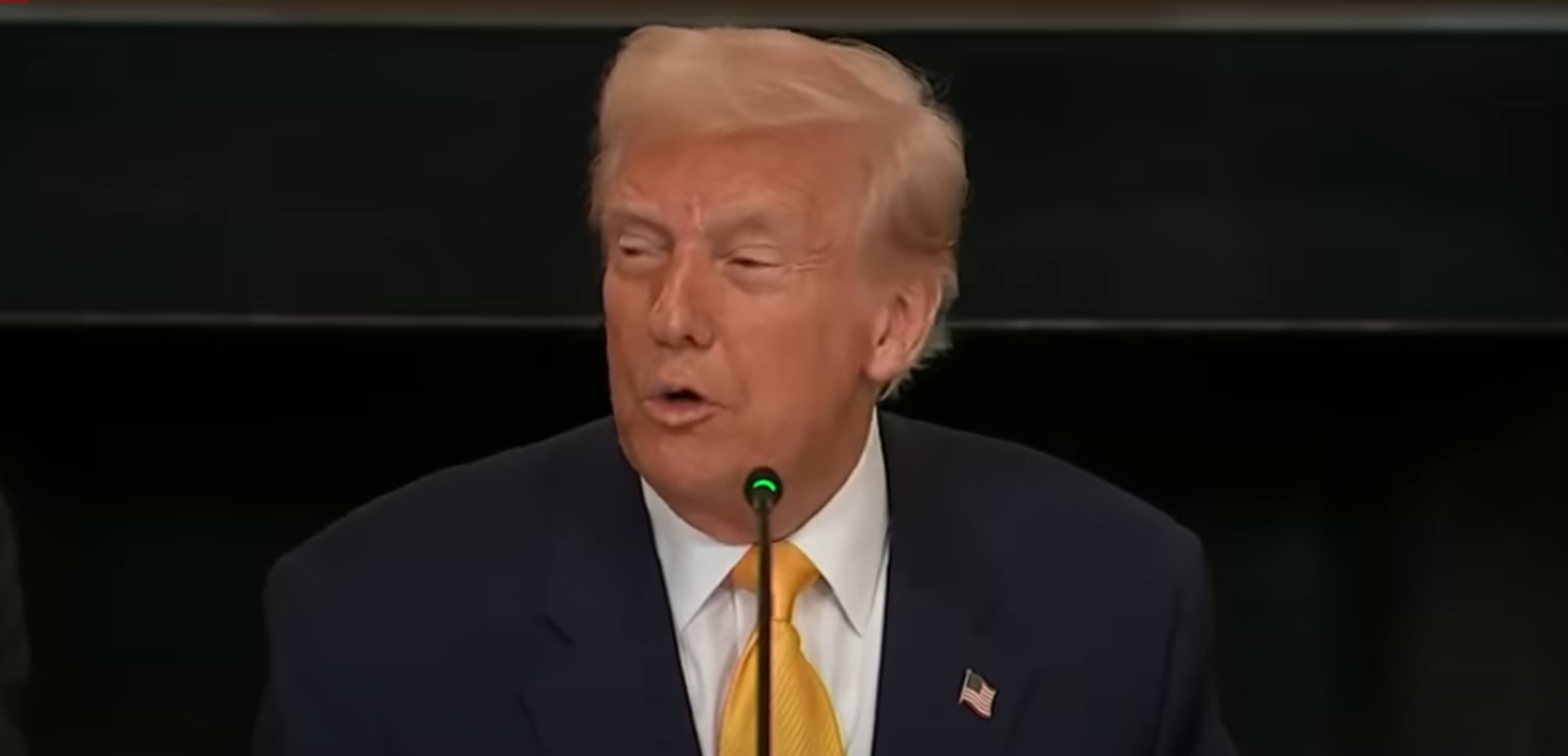

President Donald Trump signed an executive order on March 7, outlining the government's approach to utilizing Bitcoin (BTC) seized from criminal cases rather than acquiring it directly from the open market. This move led to a sharp market reaction, with Bitcoin’s price plunging over 6% from $90,400 to $84,979, according to data from Cointelegraph Markets Pro.

Regulatory expert Anastasija Plotnikova, co-founder and CEO of Fideum, noted that the decision aligns with previous government policies. “It was well understood that the U.S. government would leverage seized BTC holdings,” she said. Plotnikova found it surprising that some industry figures were dissatisfied, emphasizing that not long ago, a federally backed Bitcoin reserve was considered a radical notion.

She further highlighted that the administration’s approach prioritizes fiscal responsibility, making it a “cautious” yet pragmatic move that aligns with broader policy messaging.

Michael Saylor Urges U.S. to Accumulate Up to 25% of Bitcoin’s Supply

Meanwhile, MicroStrategy founder Michael Saylor is pushing for a far more aggressive Bitcoin accumulation strategy by the U.S. government. In a document titled “A Digital Assets Strategy to Dominate the 21st Century Global Economy,” Saylor advocated for the U.S. to acquire between 5% and 25% of Bitcoin’s total supply through consistent daily purchases over the next decade.

Presenting his vision at the White House Crypto Summit on March 7, Saylor argued that adopting a “Never sell your Bitcoin” policy could position the Strategic Bitcoin Reserve as a major financial asset. He projected that by 2045, such a reserve could generate over $10 trillion annually, securing long-term economic prosperity for the nation.

Bitcoin Community Split Over White House Crypto Summit

Reactions to the White House Crypto Summit were mixed within the Bitcoin community, with stark differences in opinion between retail investors and institutional players.

Many Bitcoin maximalists and retail traders expressed skepticism, with some viewing the event as an opportunity for government-aligned interests to push regulatory control over crypto. BTC advocate Justin Bechler criticized the summit on X, calling it “a gathering of rent-seeking lobbyists pushing state-approved surveillance tokens.”

However, institutional investors and major asset managers saw the summit as a watershed moment for digital assets. Kyle Samani, managing partner at Multicoin Capital, described the event as a historic milestone, emphasizing how far the industry has come. “We used to be fighting to survive. Now, we are leading the way in global crypto innovation,” he stated.

As the crypto industry digests these developments, the differing perspectives highlight ongoing tensions between government involvement and the decentralized ethos that has long defined Bitcoin’s identity.